Category

- Trading Academy

- Get Started

- Exchanges Guidelines

- Trading 101

- Master TradingView

When To Buy Or Sell A Coin - A Multi Time Frame Strategy

The basic theory of using the RSI is to spot overbought and oversold conditions on the price based on the level of the RSI. Generally speaking, values of RSI above 70 indicate that the uptrend is overextended, while values of RSI below 30 could signal an excess of selling pressure. How to optimize the timing to decide when it’s the best time to buy or sell in an RSI-based strategy?

From theory to practice

The theory says that you should sell when the RSI is above 70 and buy back when the RSI is lower than 30. All good, the rule is simple! Unfortunately, there is a very small issue that prevents this theory from being translated directly into an actionable trading strategy. The RSI could stay above 70 (or below 30) for a prolonged period. That leaves the trader with a lack of indication of when it’s actually the best time to buy or sell a coin.

In this case, applying blindly the rule of selling when the RSI is above 70, would have translated in missed profit of around 20%. How can we optimize to spot the best time to buy or sell?

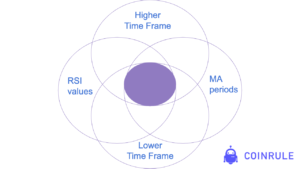

Optimize signals on a Multi-time Frame Strategy

First, mark the period in which the RSI is above 70, and do the same when the RSI is below 30 on a high time frame. So, for example, the initial signal could come from an RSI on a daily timeframe.

Then use a Moving Average to spot the best time to buy or sell the coin. So, when the price is below a Moving Average, that would indicate that the trend is weakening. On the other hand, the price above the Moving Average is a sign of momentum. I used an MA100 as it generally provides quite precise indications.

The exciting part of using Coinrule is that you can apply different time frames on your trading strategy to make it more effective.

When you identify the point at which the strategy would have triggered the buy and sell orders, zoom out again on the higher time frame to double-check the RSI values at that specific point.

Best time to buy or sell Bitcoin

One interesting thing is that I could spot this same pattern also on the Bitcoin chart.

This setup would have caught the two major turning points of the trend in the last four months.

How to build this strategy with Coinrule

Coinrule allows you to build a multi time frame strategy that analyzes different price patterns on different levels to optimize your timing—defining multiple conditions to trigger the orders.

This is an example of how you can build such a strategy with Coinrule.

Bear in mind, more restrictive conditions reduce the number of trades the rule will execute and generally should provide better results. Loosening the parameters slightly will allow for catching more opportunities but could lead to less effective trades.

Find the perfect balance for your needs by testing the setups on the Demo exchange. Play around with these four elements to create as many rules as you need until you define the ideal setup that fits your need.

DISCLAIMER

I am not an analyst or investment advisor and nothing in this article constitutes investment advice. Everything that I provide here is purely for guidance, informational and educational purposes. All information contained in my post should be independently verified and confirmed. I can’t be found accountable for any loss or damage whatsoever caused in reliance upon such information. Please be aware of the risks involved with trading cryptocurrencies.