Category

- Get Started

- Exchanges Guidelines

- Trading Tips

- Master TradingView

Learn The Aroon Indicator

Learn how to build an automated strategy to trade with the Aroon Indicator on Coinrule with TradingView signals.

The Aroon Indicator helps identify trend changes and strengths of those trends. The underlying assumption is that a strong uptrend will consistently see newer highs and a strong downtrend will consistently see newer lows. Learn more about the Aroon Indicator here.

How to interpret the Aroon Indicator

The Aroon indicator basically measures the time between highs and the time between lows over a time period. The Aroon Up line is the number of periods since a high, and the Aroon Down line is the number of periods since a low. The two lines move between 0 and 100, and the higher the value, the stronger the corresponding trend. An Aroon Up reading above 50 means a new high was seen recently, and an Aroon Down reading above 50 means a new low was seen recently.

How to trade with the Aroon Indicator

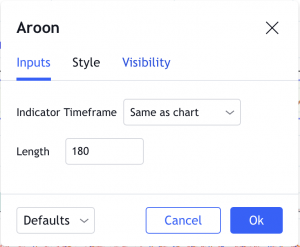

Although the Aroon Indicator is typically applied to 20 or 25 periods of data, this usually generates too much noise to trade. By smoothing out the timeframe and the number of periods, we can catch trends much more reliably.

In the chart, above you’ll see the 4h timeframe being used, along with 180 periods to calculate the Aroon indicator. This sets us up very well to trade with the monthly view in mind (4h * 180 periods = 720 hours = 30 days).

The chart shows the total market cap of cryptocurrencies excluding Bitcoin. That is a reliable index of how Altcoins are performing as a whole. The more the market is bullish, the more opportunities there are to buy the dips. As the index drops, it’s a sign that you should better hedge your portfolio allocation to Altcoins.

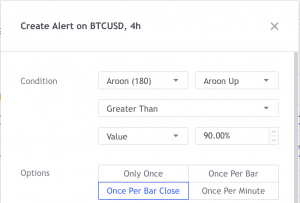

We have adapted the Aroon Indicator to use it to open shorts when Aroon Up is below 20 and to open longs when Aroon Up is above 80. By filtering out the noise and using the extremes of the ranges, we ensure that we are isolating and trading on only the strong trends. We are using this setup as a macro confirmation signal before taking positions.

Examples of rules that worked well

There are 2 types of strategies to look for when using this indicator:

- Going short/selling coins first and then buying them back later

- Going long/buying coins first and then selling them off later

In both cases, we look for confirmation with the Aroon Indicator. As we can see from the red highlighted area on the chart above, around June 5th to June 21st was a good time to be selling first and then buying later. The market was in a downtrend and strategies that pulled this off, like the one below, added value to our wallets.

On other hand, as can be seen from the green highlighted area on the chart above, around July 25th to (at least) early September was a good time to be going long. So strategies that used the uptrend to buy did extremely well.

How to set up the strategy on Coinrule

On Coinrule, create a new rule and select your exchange.

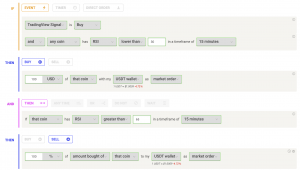

Ideally, you would create two separate rules: one for longs, one for shorts. If you have strategies in mind like one of the two above, even better. Then all you have to do is open the strategy on TradingView in a new tab and copy it over line-by-line after you select the TradingView signal setting.

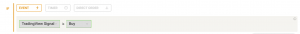

So you can use “If TradingView Signal is Buy” when you want to start with a Buy signal. Then build/copy the long strategy you want to implement when the Aroon Indicator is suggesting a strong uptrend. Examples of rules that can work well when the market is trending up are

Or you can use “If TradingView Signal is Sell” when you want to start with a Sell signal. Then build/copy the short strategy you want to implement when the Aroon Indicator is suggesting a strong downtrend. Rules that can work well when the market is trending up are

Finally, choose how many times you want the rule to trigger and name the strategy. You are now ready to launch the rule.

The final rule will look like this on Coinrule. This example shows a long setup triggered by a buy signal of the Aroon Indicator. This way you make sure the rule will execute trades only when market conditions perfectly match the strategy setup.

When you are ready to launch the rule, copy the Webhook URL and make sure that it is correctly set up in the alert you will create on Tradingview. Then, copy the message. In this case, you can paste the message just like it shows.

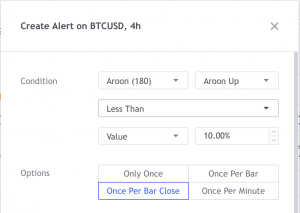

All you have to do to create the alert is:

- Add the built-in Aroon indicator to your chart

- Set the “Length” in the inputs to 180

- Add alert on Aroon depending on whether you want to long or short

- Read more about how TradingView Signals work on Coinrule.

You can now start the alert on Tradingview and launch live your rule on the market. It’s that easy to trade with Aroon Indicator on Coinrule!

Trade safely!