Category

- Trading Academy

- Get Started

- Exchanges Guidelines

- Trading 101

- Master TradingView

Scalping Oversold Altcoins - Automated RSI Trading Strategy

The best way to build an automated trading system is to find specific patterns and incorporate them into your rules. The RSI is useful to build a strategy for scalping oversold Altcoins in times of volatility.

Bitcoin’s trend showed to have further steam to keep going up these days. It’s currently forming a similar pattern to the one we had during the last week of April. The size of the price moves is even larger, and that could anticipate an even more significant breakout.

If the price moves in the same way as in April, very likely this will break upward. In anticipation of the upcoming halving, we could witness some volatility and big shakeouts could definitely happen. That makes it very challenging to set up a specific percentage trigger to buy the dips on Bitcoin. I still think that buying when the price drops is a profitable approach, especially if you have a medium to long-term investment horizon. In that case, you could buy when the price drops around 2%, that would be a reasonable approach.

Where are the best opportunities?

At this point, Altcoins have been under pressure for days, and that could offer even more interesting opportunities. If you want to start a more aggressive automated trading strategy that trades a bit more in the in a very short term, you can run some scalping on oversold Altcoins.

Looking at Ethereum, for example, which is quite a good proxy for most of Altcoins, we can see that basically, the trend was steeply on the downside since the beginning of May. We are consistently below a long term moving average (in this case, the MA200).

An interesting automated trading strategy at this point would be to buy small dips scalping oversold conditions, then take profit on small rebounds. We see that every time the RSI goes below 30, that provides at least a very short-term buy-opportunity.

How Coinrule helps you?

On Coinrule, you cans set up a strategy like the following.

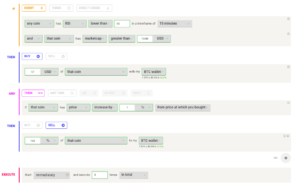

If any coin is in RSI lower than 30 in a timeframe of 15 minutes and if that coin has a market cap $100 million

PRO TIP: you could also set up an even lower threshold for the RSI (e. 20) to try to catch the very bottom of the dip.

Buy 17 USD of that coin with my BTC wallet

THEN, if that coin is a price increased by 1% from the price at which I bought

Sell 100% of that coin back to my BTC wallet.

Adding a filter for market cap in the first condition allows you to avoid buying some random shitcoin with your strategy.

Altcoins always have higher volatility than Bitcoin, so in times of uncertainty, scalping oversold Altcoins with short-term trades allows you to catch more opportunities and add value to your wallet.