Category

- Trading Academy

- Get Started

- Exchanges Guidelines

- Trading 101

- Master TradingView

How To Buy Crypto In The 2021 Bull Market

Traders are strange. They love Bitcoin and cryptocurrencies when they trend up and then panic sell when the market corrects. Keeping in mind that the golden rule is always to buy-low-and-sell-high, how to buy crypto in the 2021 Bull market?

Dollar-cost averaging is a great option to accumulate cryptocurrencies in the long-term. It involves splitting the investment into multiple buy orders over time. In this way, you can reduce the price volatility effect, averaging your cost of purchase. You may not buy the perfect price bottom, but certainly, you don’t risk buying the top as many traders and investors did in 2018.

A smarter way to buy crypto

You can optimize further the DCA approach by adding technical indicators to your strategy. That allows you to spot the best time to buy crypto, even in a steep Bull Market like the one we are experiencing in 2021.

The RSI is a handy indicator in a Bull Market, as it helps identify quite precisely the price dips and thus the best time to buy crypto. Every time the RSI is lower than 30, generally, that represents a very convenient buy opportunity.

The long-term game

Crypto Bull Markets, on average last around one year, so we may still have some months ahead to take advantage of prices trending up.

One of the main risks in a Bull Market is to buy crypto when their price is going up, falling into the FOMO traps, rather than waiting for the price to retrace at more reasonable prices. That’s what buying at low values of RSI is meant for.

Another tricky mistake most traders make in a Bull market is to forget to take profit on the way up, as they are too confident in the trend’s strength.

To avoid that, the rule takes profit on the buy orders when the price increases on short-term surges.

How to buy crypto and take profit with Coinrule

First, you need to identify the coins you want to accumulate in the coming weeks. Would you like some suggestions? This article describes the biggest crypto trends in 2021 and lists the coins that may result as winners at the end of this Bull Market.

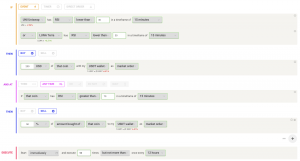

On Coinrule, you can set up to three coins per rule to trade. Every time one of these coins dips, the rule will buy the set amount, and then it will sell in profit part of the position once the price rebounds.

to buy Before launching the rule, don’t forget to set the frequency of the buy orders. You can set the rule to run “no more than once every 12 hours,” for example. In this way, you make sure that the strategy doesn’t run out of capital soon, and you don’t overexpose your with too many trades in a short period of time.