Category

- Trading Academy

- Get Started

- Exchanges Guidelines

- Trading 101

- Master TradingView

Multi Moving Average Crossing

This rule aims to optimise a classical moving average crossing strategy. A medium-term and long-term moving average is used for the entry signal, while a short-term and a medium-term setup triggers the exit.

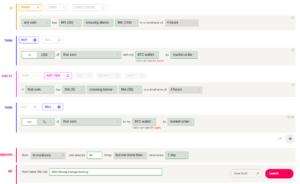

Buy Condition

The strategy buys the coin when the MA(50) crosses above the MA(100) on a 4-hour time frame. That should signal the start of a medium-term uptrend.

Sell Condition

Then, the algorithm then sells the coin when early signs of trend reversal appear. In this case, the MA(9) crossing below the MA(50) in the same time frame (4 hours) represents a weakening of the trend and it’s used as a trigger.

How it Works

A typical moving average-based strategy employs the same setup for triggering the buy and the sell signal. Medium and long term moving averages allows more precise signals but due to the lagging nature of the indicator that risk to delay the closing of the position.

This rule uses a shorter moving average to spot the timing of the sell order to increase the possibility of a profit and to reduce the length of the trade.

Build the Strategy with Coinrule

A multi moving average crossing strategy is a valid option to catch the early stages of an uptrend. The sell signal is very sensitive to pullbacks that could close the position too early. On the other side, being more responsive to the trend should allow to secure more frequently trades in profit.