Category

- Trading Academy

- Get Started

- Exchanges Guidelines

- Trading 101

- Master TradingView

How To Trade Crypto?

Trading vs Investing explained

What is the difference? Investing in Bitcoin usually means to buy Bitcoin for the long term because of an underlying belief in the value of the asset.

In other words, the investor believes that the price will ultimately rise to match its long-term value, regardless of the daily market volatility. Usually, people invest in Cryptocurrencies because they believe in the Blockchain Technology or in the companies that are building the ecosystem. Since they don’t care much about the ups and downs of the price, Crypto investors tend to HODL the coins long term.

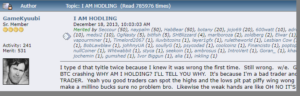

HODL is a popular term in the Bitcoin community that gets its origin from a typo of the word “hold” that appeared in an old 2013 post in the Bitcoin talk forum.

Trading, on the other hand, puts the main focus on the current price of the asset. Whenever it trades lower or higher, all that matters is to make a profit.

Traders view Cryptocurrencies as a mere instrument for making profits, sometimes they don’t really care about the Technology or the ideology behind the tokens they’re trading.

Why do people love to trade cryptocurrencies?

Because crypto is very volatile, and so you can make a nice amount of profit if you manage to predict where the price is going correctly. Additionally, crypto markets trade 24/7, providing endless opportunities around the clock.

Last but not least, cryptocurrencies are unregulated assets which makes it relatively easy to start trading without much paper-work or procedures.

Not all traders are the same, though.

Read here about the techniques that traders use to make consistent profits every day.