Category

- Trading Academy

- Get Started

- Exchanges Guidelines

- Trading 101

- Master TradingView

Trading Strategy For Beginners On Coinrule - Catch The Dips

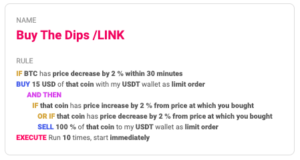

Taking your first steps into automated trading may be challenging. Our mission is to make it as easy as possible with our platform. Here follows the best trading strategy for beginners on Coinrule. It’s a simple trading system that you can run for free forever on a Starter plan. The strategy buys the dips of a coin to sell with a profit. A stop-loss protects every trade.

Buy Condition

Crypto markets offer high volatility and, thus, excellent opportunities for trading. Excluding times of severe downtrend, buying the dip is a simple and effective long-term trading strategy. The buy-signal is set to a 2% drop in a 30-minutes time frame.

Sell Condition

Each trade comes with a take profit and a stop loss. Both set at 2%. You can adjust these percentages to the market volatility as an advanced setup.

The parameters of this strategy are very intuitive and make this system the best trading strategy for beginners on Coinrule.

You can backtest the outcomes using the backtesting tool from Tradingview.

How to backtest the strategy on Tradingview

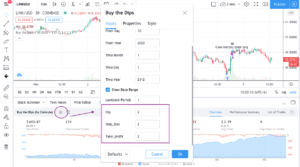

As a first step, select the coin on which you want to run the strategy. Then, choose the 30-minutes time frame for the chart. Finally, find among the “Indicators and Strategies” those published by Coinrule. Select Buy the Dips.

Adding the strategy to the chart, you will get the historical results from the backtesting tool. Net profit, the profit factor, the percentage profitable, and the max drawdown represent great indicators to assess the strategy’s quality.

Adjusting the parameters to experiment and optimize the results is very easy. As market conditions may vary over time, and the volatility can increase or decrease, you may try to improve the setup to catch more opportunities. Values by default are set to 2% for the dip, the take profit, and the stop loss, but you can easily modify them and see in real-time how performances would have changed.

By default, each trade has a size of 30% of the total capital allocation. That helps in providing a more reliable profit’s outcome, fitting your needs. You can increase or reduce it according to the amount you are going to trade.

Another essential aspect of assessing an automated trading strategy’s profitability is to account for trading fees. The default value is 0.1%, which is the base fee paid on Binance, the largest cryptocurrency exchange. Change the percentage to make it equal to your transaction cost on the exchange you will use to run the strategy.

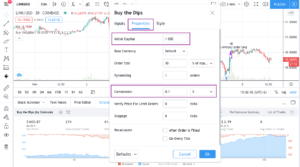

Now that you are confident about the setup of the strategy, you can launch it on Coinrule.

How to build the Strategy with Coinrule

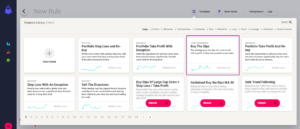

The strategy “Buy the Dips” is available among our templates. It’s free for all our users. All you need to do is to connect an exchange to unlock the template.

Once you selected the template in the library, all you need to do is complete some parameters for the rule.

- The coin you want to trade. If you want to run the strategy on multiple coins, you can choose “any coin” (all available on the market) or “any of my coins” (all those that you already hold in your wallet).

- The wallet you want to use to trade the coin. For example, if you want to trade Bitcoin, you can select a fiat currency or a stable coin. For more info on the topic, read here.

- The amount you want to trade for each order.

You are now ready to launch the best trading strategy for beginners on Coinrule!