Category

- Trading Academy

- Get Started

- Exchanges Guidelines

- Trading Tips

- Master TradingView

The Relative Strength Index

The Relative Strength Index (RSI) is a widely used technical indicator that measures the strength of the price trend over a specified period. The mathematical formula backing the indicator takes into account the percentage of price moves up compared to those down. The more the up moves overweight the price drops, the more that means that the price of the asset is in a solid uptrend.

The general idea is that the faster the price is moving upward, the more likely it is that it reverts its trend down. One of the most interesting peculiarities of the RSI is that it’s very straightforward to use. The value can only range between 0 to 100, so the trader can identify easily overbought and oversold price conditions.

How to use the RSI

The default values of RSI that mark the overbought and oversold areas are respectively 70 and 30.

For example, a value of RSI above 70 means that the asset is trading in a sustained uptrend. In the chart below, we can easily spot the areas where it’s more profitable to buy and where it’s more appropriate to sell.

Identifying the buy-zone when the RSI drops below 30 is a very straightforward approach, but that doesn’t suit a perfect trading system.

Given that the value of the RSI can only assume (theoretically) also values very close to 0, that means that the indicator can drop much lower than 30. On top of that, the RSI can stay in oversold conditions also for very long periods.

There is no guarantee of profit in buying an asset only because the RSI is flagging oversold conditions. You should employ risk management tools to reduce the risk of the trade.

RSI Divergences

Spotting overbought and oversold price areas is very useful when the market doesn’t have a clear direction. Just looking at the value of the RSI alone during trending market cycles can be misleading. The good news is that the RSI provides much more information about the price, and this information can be significant in any market condition.

You can look at the RSI in parallel with the price of the asset to spot for divergences. A classic example of divergence occurs when the price keeps marking higher highs, but at the same time, the RSI shows lower highs. That represents a signal that the uptrend is weakening, and a reversal could happen soon.

You can read more about Divergences and how to get the best out of them here.

How to trade with the RSI on Coinrule

The RSI is a handy indicator that permits to optimize the executions of any trading strategy.

Let’s consider, for example, a Dollar-Cost Averaging automated trading strategy. The goal of this strategy is to buy a coin periodically, reducing the effect of the volatility on the investment. What if you could optimize this rule buying only when the price conditions are more convenient?

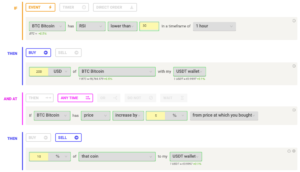

When the RSI signals an oversold price condition on Bitcoin, you can catch this opportunity to accumulate more. Setting the maximum frequency of the execution, you can define how much and for how long you want to accumulate. For example, if you plan to build a long-term DCA strategy you could consider setting up the rule to run 50 times but not more than once every one day before launching the rule.

You will find more template rules based on the RSI when creating a rule!

Main Takes

We can now outline three main conclusions:

- The RSI can stay at very high or low values for long periods, so, alone, it may not spot the best timing for buying and selling. Consider combining it with another indicator to increase the preciseness of the timing of the trades.

- Since RSI can signal an overbought market condition that could remain for a prolonged time, in some cases, it may be not appropriate to consider it an indicator of an immediate reversal. Instead of using a contrarian strategy, in that case (i.e. selling the coin), it’s possible to combine the RSI with another trend following indicator, such as a moving average, to run a trend-following strategy.

- The best signals that the RSI provide are the divergence with the price. It provides useful insights about the strength of the trend to gauge the likelihood of a reversal.