In our last Blog post on Medium, we discussed the huge 20% price spike that bitcoin price experienced in a matter of a few hours. In the following week, the price kept trending upward. Everyone was so optimistic about a new altseason to come soon, after some days of

What does that mean? Probably just that means that we can’t go up vertically and the crypto market still tends to overreact significantly on big price swings.

Speaking of this, last week Binance released a great article about cryptoassets market circles. The thing that I found most interesting was the empirical findings to prove the effect of HODLing on bitcoin price.

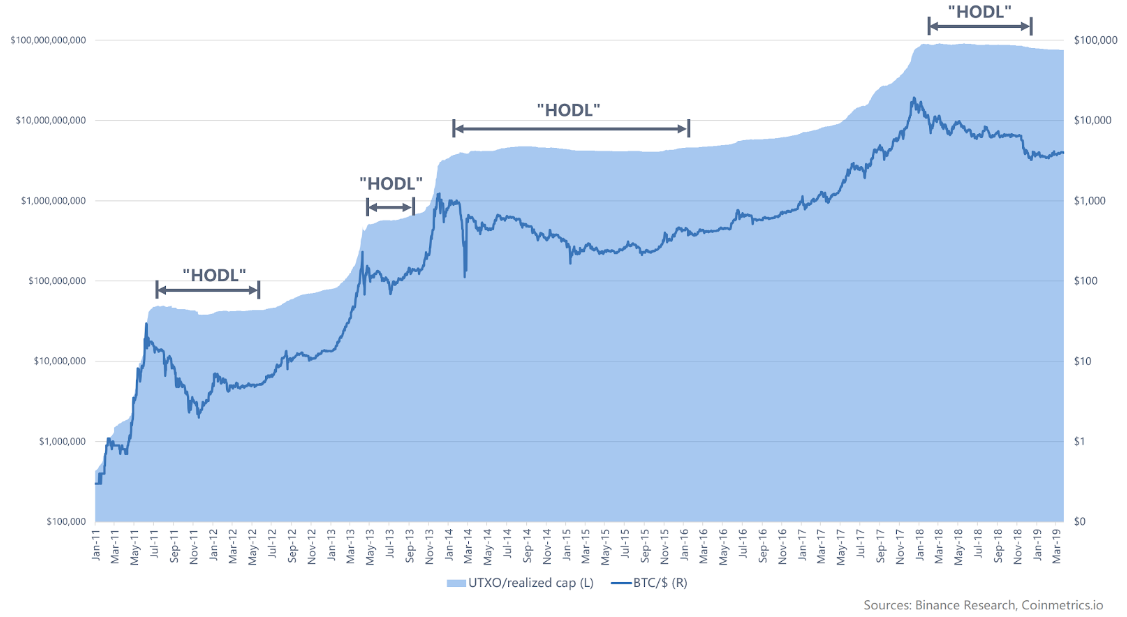

Here is a chart from the article, where the price of Bitcoin is compared to the market capitalization weighted for the actual on chain transactions occurred in that period, this is based on the UTXO market cap created by Pierre Rochard.

The advantage of this methodology is to exclude the non-active accounts (or HODLers) from the calculation of the market cap. And what we notice is that during the 2014 bear market, the price of Bitcoin fell by 75%, while UTXO Cap actually rose by 15%! In the same way, in 2018 the price drop was about 70%, while the UTXO cap only fell 5%.

The most significant conclusion we can get from this is that in every market circle there is a considerable share of investors not interested in trading but they just want to store their coins, being confident that the price will rise again.

That leads to another outcome. There is another share of investors, smaller but still significant, they are mostly traders and, since their goal is not holding long term, they will be focused mainly on short-term gains. Ready to react (or, often, to over-react) to short term price swings. They are the main driver of the short term price moves.

Also, if you consider that cryptocurrencies are still very illiquid assets, if you take out from the available-to-trade coins those that are stored by HODLers, this illiquid component is even stronger and effects the price even more.

Fewer coins to trade mean that even relatively small order quantities can move the price significantly!

As we can see also from the last days in Bitcoin market, that’s why optimism drives up parabolically and, on the contrary, that optimism can turn into pessimism very quickly causing a market tailspin.

That’s how we pass quickly from FOMO to REKT!

Emotions and feelings in trading can be very damaging, that’s why planning a trading strategy, even a simple one, and run it automatically can free you from a painful daily stress.

This is even more reflected in the Altcoins market. Altcoins often underperforms BTC in times of drowdown, when panic spreads their price usually dumps pretty hard, probably also because of its illiquid component we were talking before. But these dumps also create excellent buy opportunities!

When BTC price recovers, Altcoins catch up and during periods of low volatility in Bitcoin price they tend to overperform again.

We think that the worst of the bear market could be passed and it’s an excellent time to start accumulating with caution some altcoins for the next bull circle.

With coinrule, you can easily set up an automated trading strategy to accumulate your favorite altcoin. For example, we like Litecoin. It poster an impressive performance since the beginning of 2019.

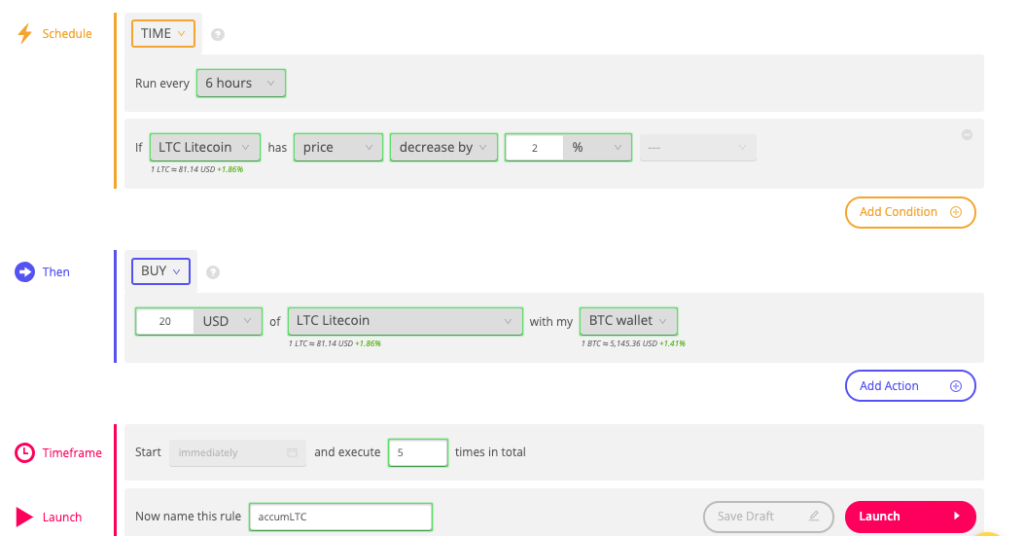

For example, in a few quick steps you can define a strategy like this:

Every 6 hours, if Litecoin price has a price decrease of 2% buy 20 USD of Litecoin and do it five times.

Here is your automated trading strategy live!

Never rush into a trade, plan your trading idea, implement and run it with Coinrule.

For more market views and trading ideas, follow us on Twitter @CoinruleHQ

TRADE SAFE AND DO YOUR OWN RESEARCH – THIS ARTICLE DOES NOT CONSTITUTE ANY FORM OF INVESTMENT ADVICE!