Category

- Trading Strategies

- Get Started

- Exchanges Guidelines

- Trading Tips

Short with the Trend MA 9/MA 50

The rule aims to build a “sell the rallies” approach by combining it with short- and medium-term moving averages. The deployed MA50 identifies bearish trends and ensures the strategy only trades during these periods. This strategy allows you to add value during times of downtrends by trading in and out of existing holdings or by reducing your exposure through shorting in the futures markets.

Multi Time Frame Crossing Reversal

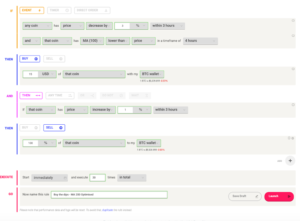

Sell Condition

The strategy sells the coin when it meets the criteria below:

- MA9 crossing below MA50 in a timeframe of 30 mins

Buy Condition

The algorithm then sells the coin on either of the 2 following conditions:

Stop Loss: Coin has price increase by 2% from price at which you sold

Take Profit: Coin has MA50 greater than price AND price crossing above MA9 on 30 mins

The strategy has a 3% stop loss. With such tight stop-losses, depending on your ability and willingness to take risk, you can consider using leverage (link article here) to increase your gains.

How it Works

First, MA9 crossing below MA50, signifying a short-term downward move, identifies a current price trend. If this cross below condition is not met, the strategy will not trade.

If the price crossing above MA 9 and price lower than MA 50 conditions are satisfied, buy to close out the position. Otherwise, there’s a stop-loss of 3% from the entry price.

How to Build the Strategy with Coinrule (Strategy screenshot)

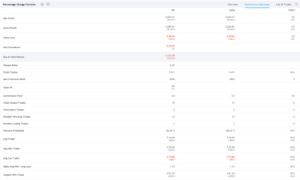

Strategy Performance (ETHUSDT – 30% price drop vs 10% gain)

Over the period, the strategy beat the buy and hold return by about 40%. and achieved an absolute profit of 10%. If you were holding the coin, this was a low-risk way to add value to your account balances. If you were shorting, this was a great way to make extra profits while reducing your overall exposure to the market.