Category

- Trading Academy

- Get Started

- Exchanges Guidelines

- Trading Tips

Dollar-Cost Averaging Accumulation

Even in times of severe bear market, it is possible to find some good opportunities among all the projects out there. An option for managing your portfolio is to accumulate those coins that have a solid basis and are undergoing a steady development, letting an automatic trading strategy send the buy orders following certain predefined rules.

The perfect long term Crypto Strategy

With Coinrule you can decide when it is more convenient to buy one or more coins and let the rule execute your orders with no need to watch the market 24/7.

Using charting analysis, you can identify critical price levels and decide to buy a small portion of the asset with different orders. In the example above, we identify a specific condition (a particularly “oversold” status of the technical indicator) to decide to send a relatively small order to accumulate to our position.

Distributing your buy order across a more extended period of time, gives you the possibility of buying also at a lower price, lowering your average cost of purchase. This strategy is called Dollar-cost averaging (DCA), and there are two ways to implement this strategy.

Time-based Dollar-cost averaging

You can set up periodic buy orders, no matter what the market conditions will be. If you spread your orders across a sufficiently long time frame, you will be able to reduce the volatility of your executions.

A trading bot like Coinrule allows to set up a long term strategy in just minutes and work for you 24/7 for weeks or months!

Price-based Dollar-cost averaging

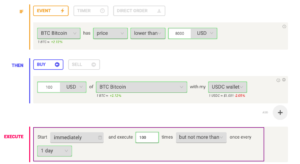

Another approach is to set up a price threshold that you consider a convenient level to buy. Every time the price drop below that level, the bot will send a buy order.

It’s very useful to use this logic if you want to prevent executions at undesired prices, but bear in mind that if you set a price too low you will have less chances to accumulate your coin.

Also, if you set up a rule like this, remember to define how often maximum you want to execute a buy order to avoid over-trading!

The “Coinrule way” to run a Dollar-cost averaging strategy

While you are accumulating your coin, at the same time you can also take profit on part of your position. Selling part of your coins back to your base currency will give you the possibility to accumulate more and for a longer time. Quite smart!

In all these cases all the parameters are fully customisable to meet every traders’ need. Whatever parameter you will set, the rule will run automatically 24/7, so you won’t miss a dip of your favorite coin anymore!