Category

- Trading Strategies

- Get Started

- Exchanges Guidelines

- Trading Tips

Trend-following RSI Strategy

According to classical technical analysis, an RSI above 70 should signal overbought conditions and, thus, a sell-signal. Cryptocurrencies represent a whole new asset class, and they reshape the classical concepts of technical analysis. FOMO-buying can be very powerful, and coins can remain in overbought conditions enough to provide excellent opportunities for a trend-following RSI strategy.

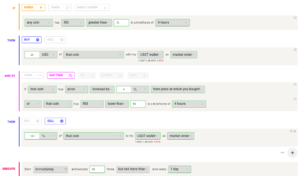

Buy Condition

The strategy’s buy-signal triggers when a coin has an RSI above 70 on a 4-hours time frame.

We published on Tradingview a trading script that you can use to backtest this strategy optimizing it according to your needs.

Sell Condition

The strategy sells the coin if a profit of 6% is achieved. Alternatively, it closes the position if the RSI drops below 55, indicating a possible weakening of the trend.

How it Works

The strategy tries to catch coins on sustained uptrends to take advantage of further upside.

Building a trend-following trading strategy based on the RSI, which is generally considered a contrarian indicator, may sound counter-intuitive. Over 200 backtests prove that this is a very interesting long-term setup.

How to Build the Strategy with Coinrule

The base setup above allows multiple trades at the same time, having selected the “ANY TIME” operator. In this case, remember to choose the maximum frequency of the buy orders by setting up the “no more than …” option before launching the rule.

Building the rule with the “THEN” operator, instead is a more conservative approach that makes the bot trade one coin at a time.